Microsoft Dynamics 365 Business Central

Financial management

360 degree view of your finances Microsoft Dynamics 365 Business Central

Highlights

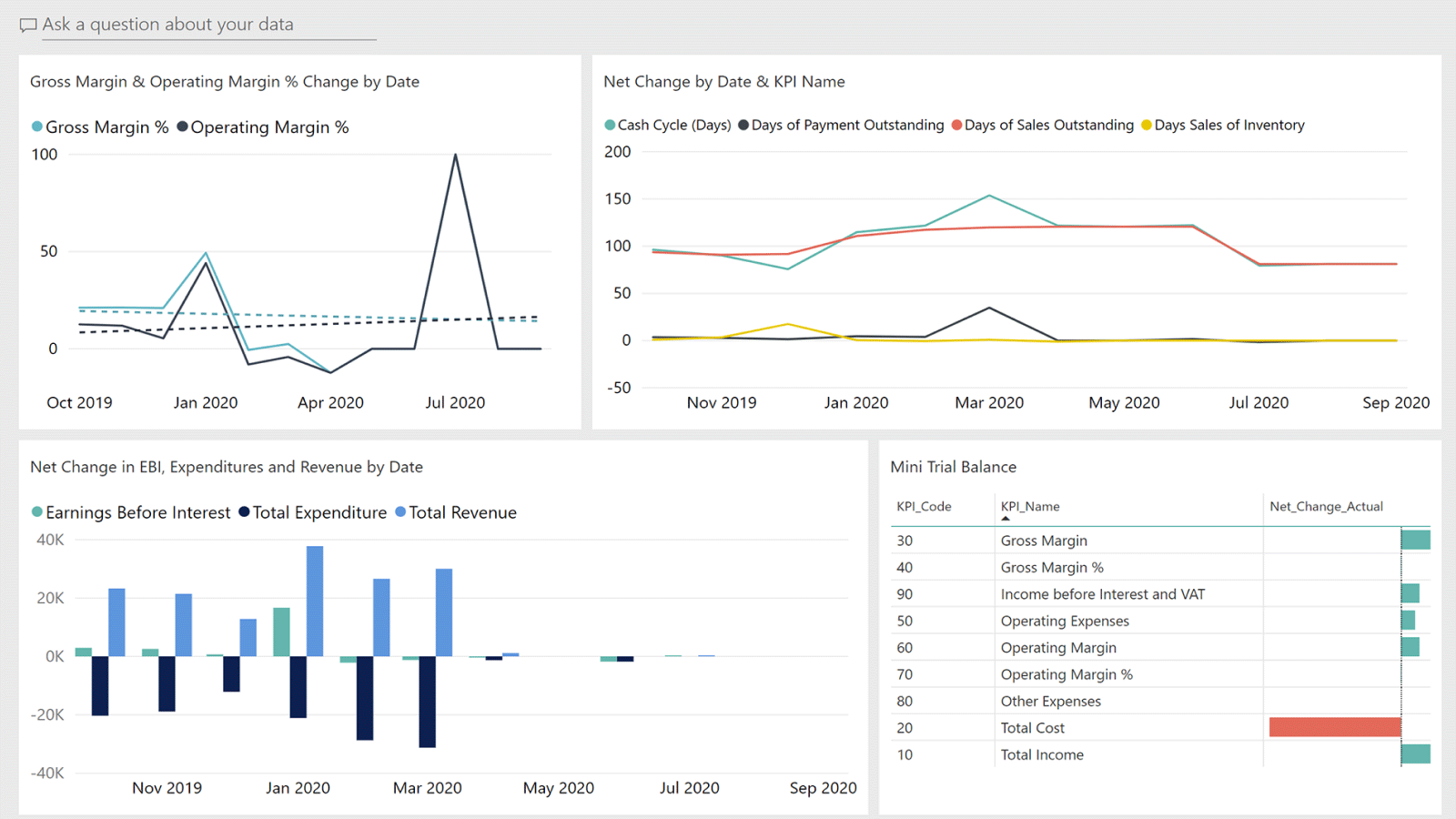

- Comprehensive financial status reports

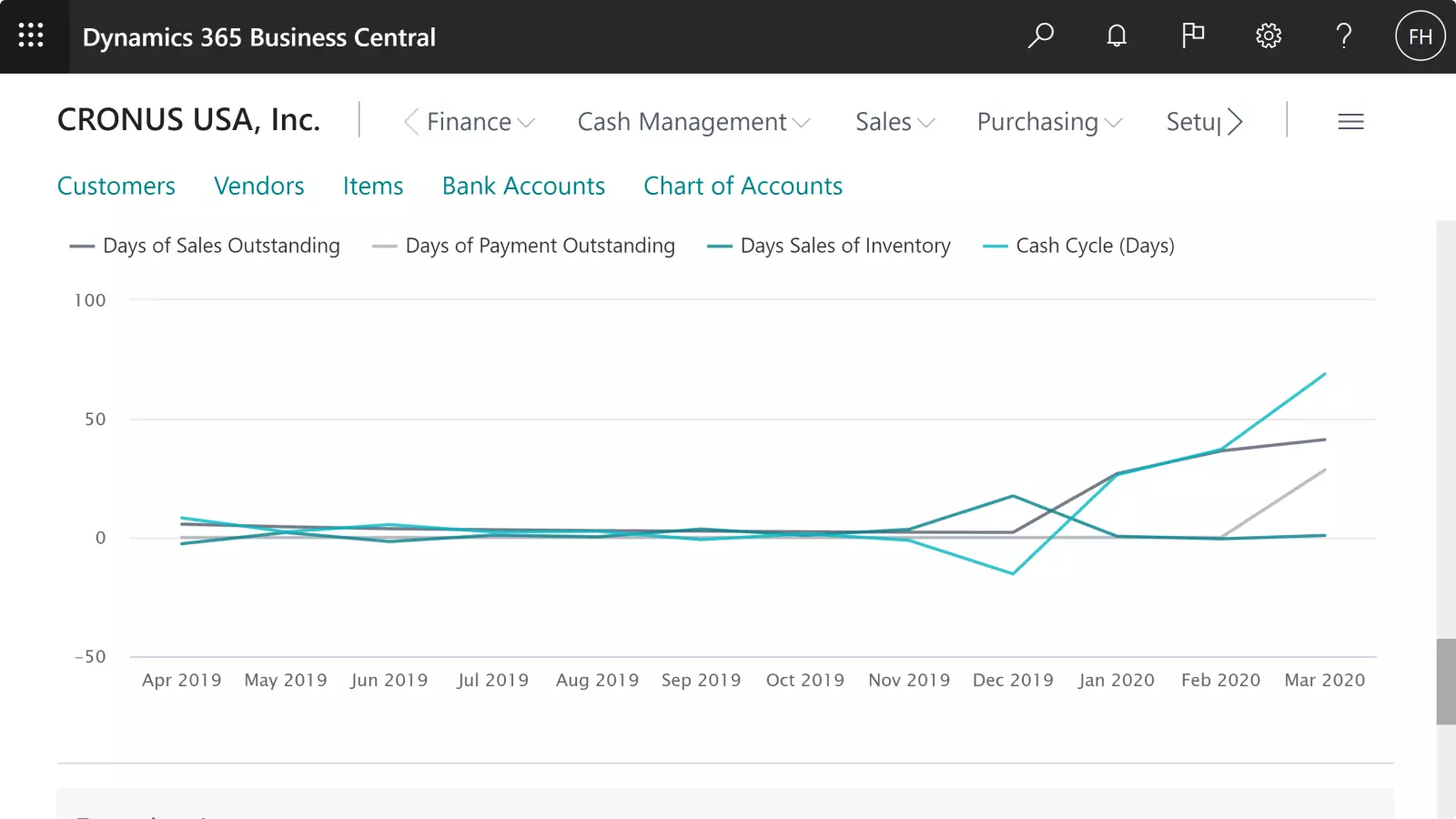

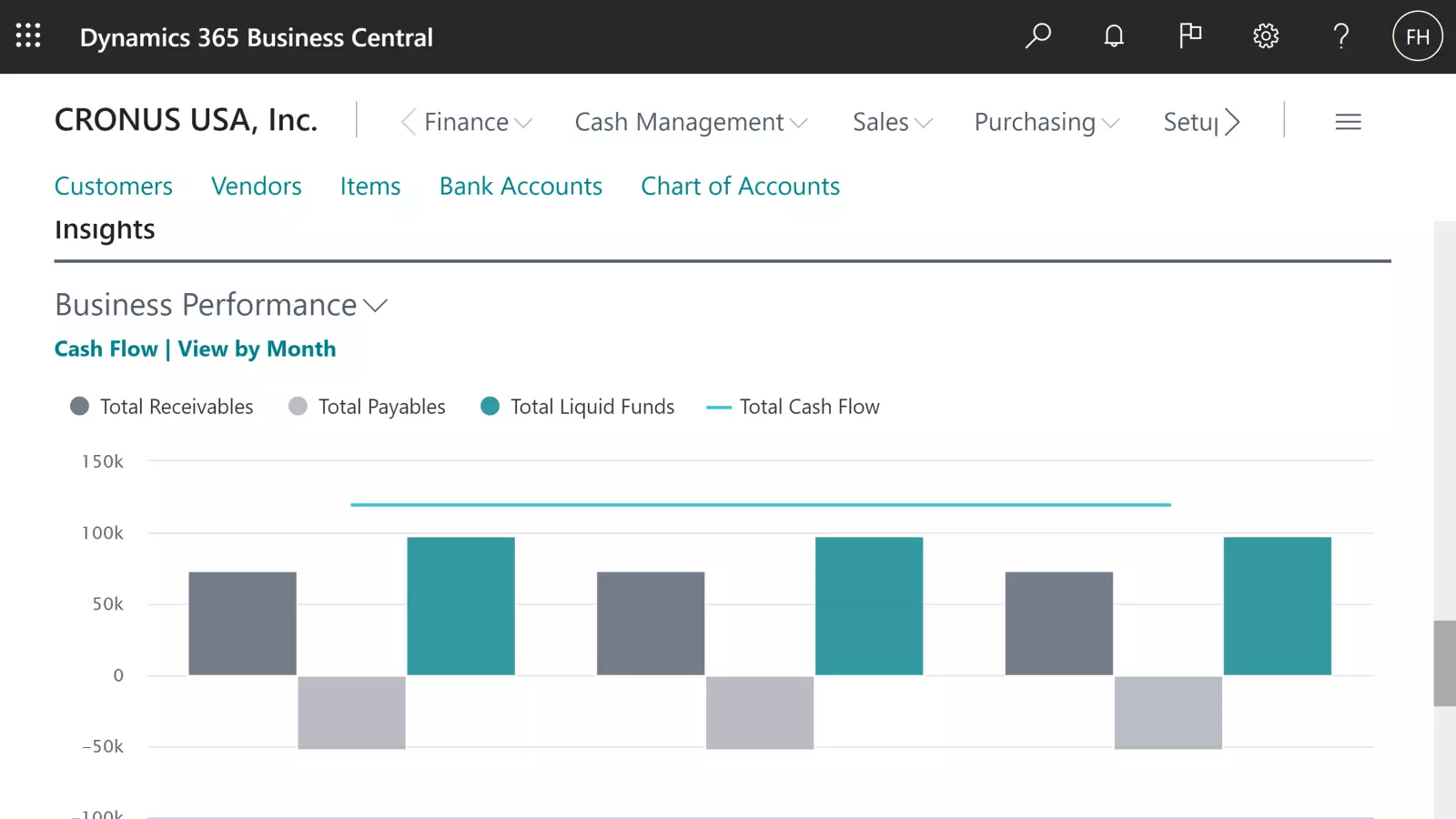

- Cash flow & liquidity forecasts

- Controlling the success of eg products, customers or company divisions

- Extensive expansion options for financial analysis through business analytics

Get to know Business Central

- Certified financial accounting

- Fixed assets, accounts receivable, accounts payable

- Payment transactions & dunning

- financial statements

- Financial development and cash flow

Do you have any questions or would you like to talk about a project?

Relief for your finances through the integrated certified financial accounting

- Chart of accounts according to economic sector including associated charts of accounts

- Basic, main and subsidiary ledgers

- accruals and deferrals

- Profit and Loss Account, Balance Sheet

- multi-tenancy

- Intercompany Bookings

- consolidation

- currency management

- Certified interface to DATEV

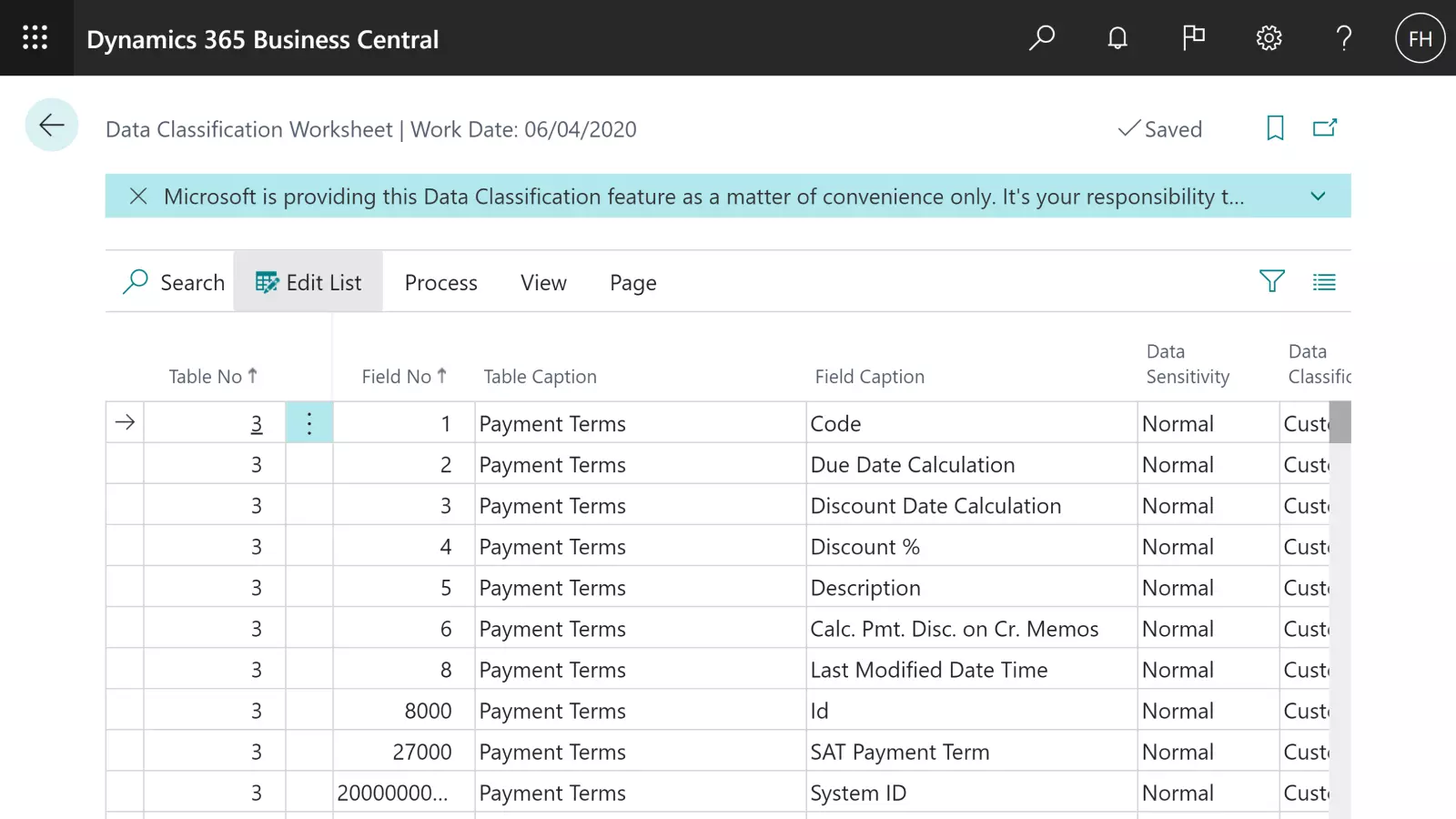

Included as an ERP system Microsoft Dynamics 365 Business Central a complete and integrated financial accounting that provides your employees with extensive preparatory work: The quantity or service flow is simply automatically posted in terms of value according to the double principle. In addition, the associated documents such as sales orders, orders, invoices, etc. are archived in an audit-proof manner.

This means that you always have your books up to date and can also call up the current financial status, cash flow and financial development. If you have any questions or are unclear, you can track all processes in the company down to the transaction or document level.

If you have partially or even completely outsourced your financial accounting to your tax consultant, we can digitize the transfer with the certified interface to DATEV.

Minimize manual postings in accounts payable and accounts receivable

In addition, routine postings such as accruals and accruals that are due can be accelerated using templates. In addition, sources of error are reduced.

- Clear management of debtor/creditor accounts

- Automatic account reconciliation

- Seamless tracking of receipts

- Templates for recurring routine bookings

- Audit-proof archiving of documents

- Complete integration in payment and dunning

Monthly statements, the P&L and accounting

- Accounting according to HGB and IFRS

- Monthly and periodic closings

- Inventory evaluation and evaluation

- Advance VAT return

- Electronic submission of reports

Optimization of payment transactions and dunning

The SEPA electronic payment transactions will also be included Microsoft Dynamics 365 supported and automated with extensive functionalities for transfers, direct debits, standing orders, etc. for domestic and foreign business partners.

Using payment proposal lists, your accounting department can initiate payments on time on a daily basis and use discounts if desired. The same applies to the collection of direct debits. The daily reconciliation with your bank accounts takes place digitally and automates the posting of account statements. This way, you can keep an eye on your finances on a daily basis and, if necessary, take measures to secure liquidity at an early stage and take financial account of long-term investments.

In addition, the resolution of discrepancies between payments and open items is significantly facilitated by corresponding overviews and posting proposals.

Last but not least, the processing of your customers' payment delays is considerably simplified: using rule-based dunning runs, overdue invoices are displayed in dunning proposal lists, from which reminders are generated and sent either automatically or by manual release based on criteria.

- Management of bank data per business partner

- Management of payment types per customer/order (payment in advance, partial/down payment, installment payments)

- Management of rebates, cash discounts, bonuses, etc.

- Automated payment proposal lists for bank transfers and direct debits

- Payment runs, individual and collective direct debits, transfers, standing orders

- Bank reconciliation also across multiple clients

- OP compensation

- Automatic dunning

- Connection to collection systems

- credit checks