Item costing without external tools such as Excel

Freely definable calculations and various evaluation bases

strategic pricing and cost control

Why Item Costing as an app?

Do you still use external tools to carry out price and cost calculations for your items?

With our integrated solution Item Costing for Microsoft Dynamics 365 With Business Central you save yourself system changes and work with a uniform and reliable data basis. This makes your calculations less error-prone, you become more efficient in determining your offer prices and can therefore react more quickly to customer inquiries.

- Setup for creating setup data and demo data

- Freely definable calculations

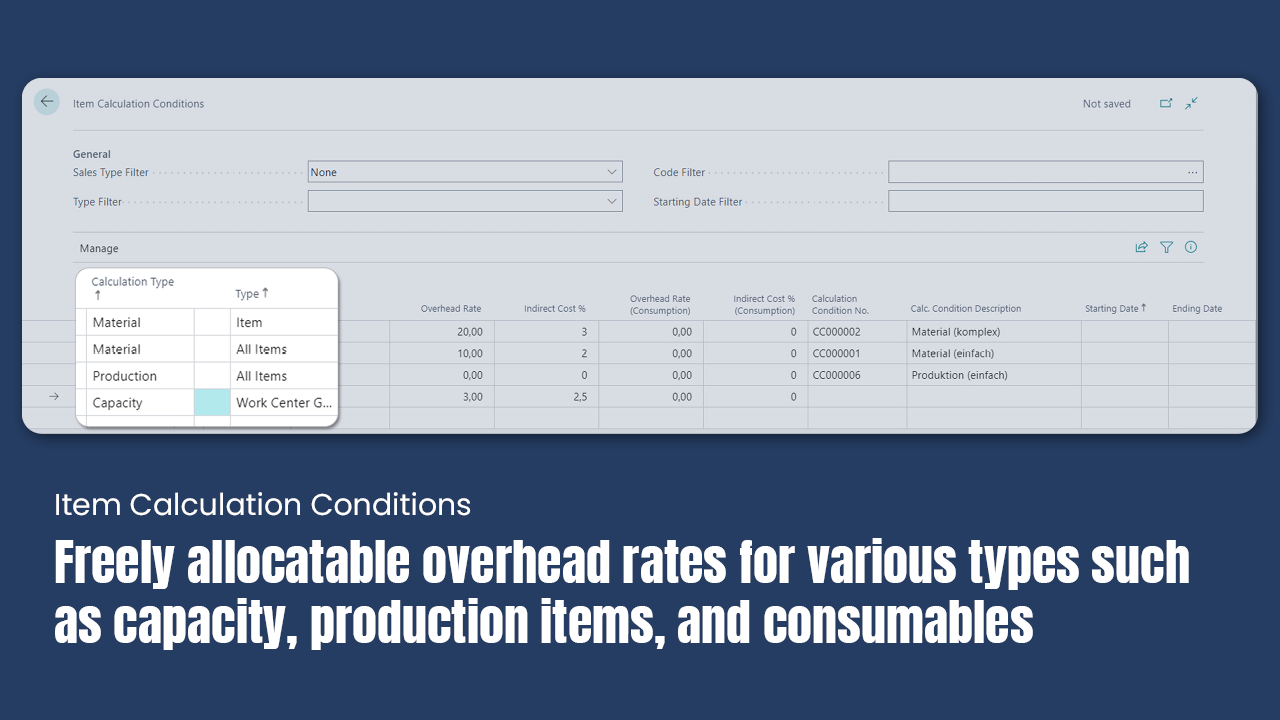

- Material overhead costs in the manufacturing process (consumption-activated material overhead costs)

- Overhead costs for external labor

- Flexible surcharge and overhead rates

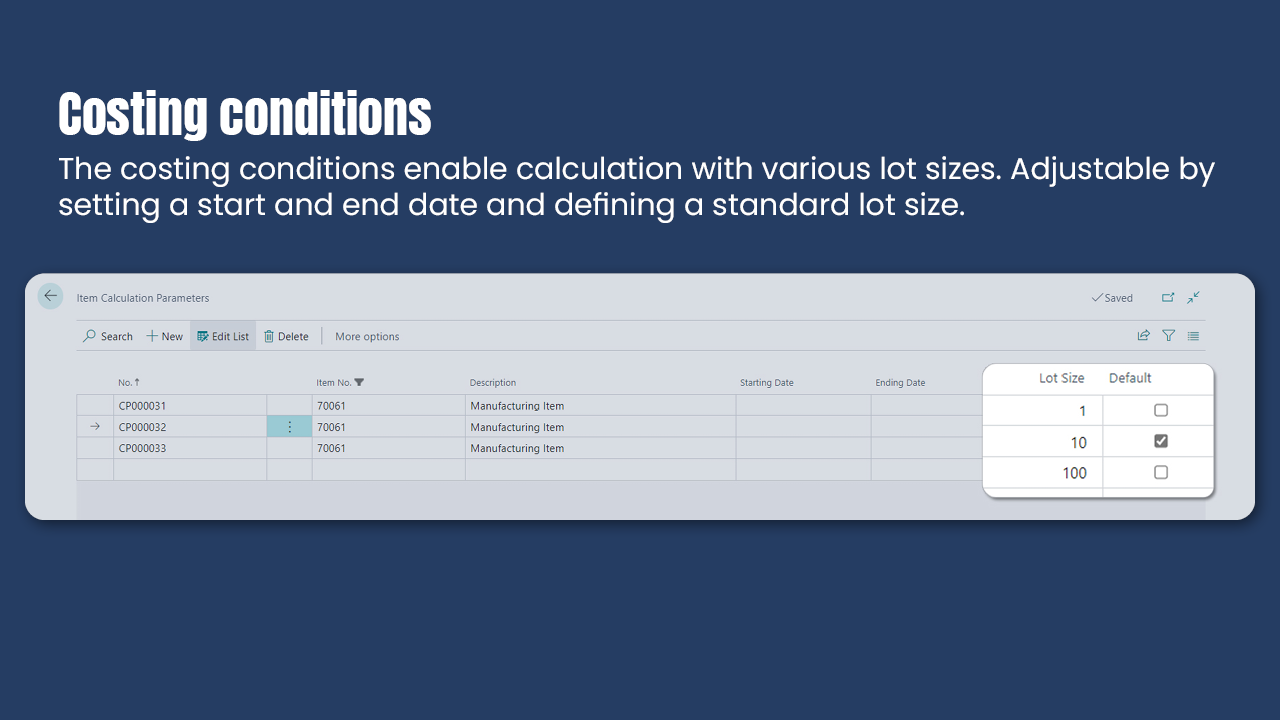

- Calculation of alternative lot sizes

- Various valuation bases for item calculation (cost price, direct costs, purchase price)

- Calculation comparisons

- Adoption of target prices in the master data

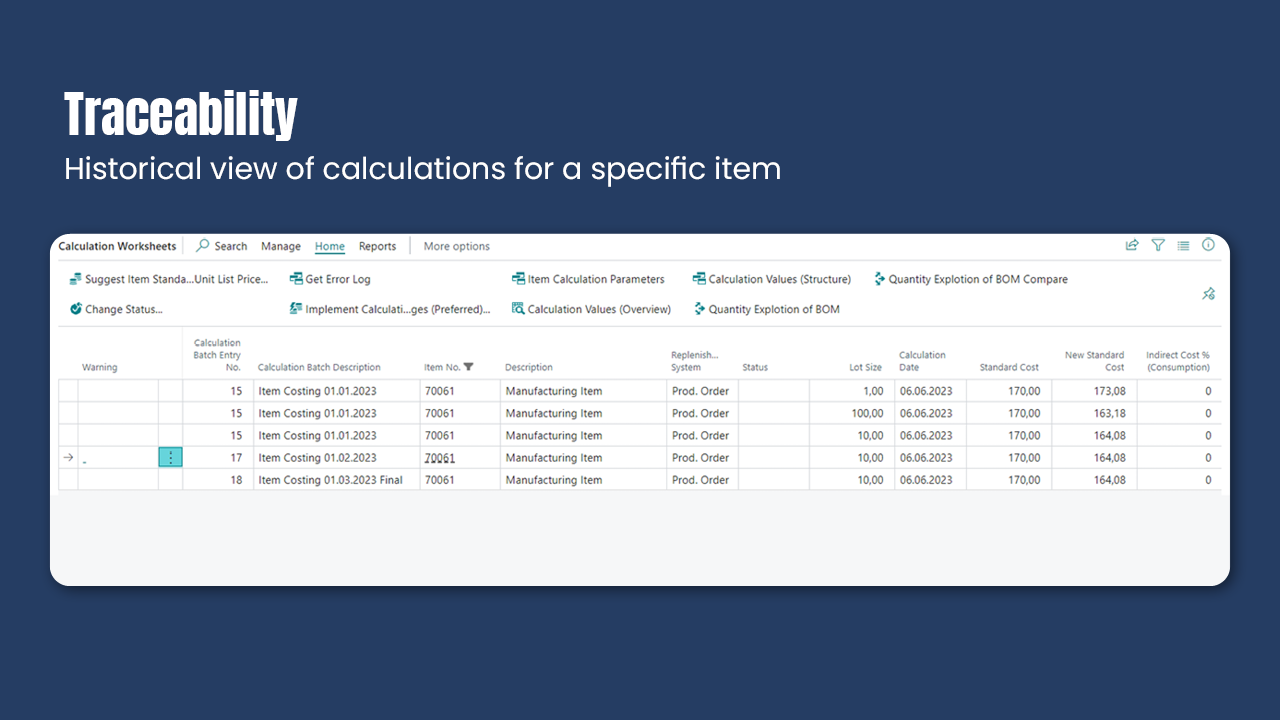

- Display of historical calculations

- Meaningful error log

- Consideration of the previously listed extensions also in the operational accounting processes (consumption-activated material overhead costs, overhead costs for external labor, flexible overhead rates)

Just try it:

Download Item Costing from Microsoft AppSource

Would you like to buy the app?

Licensing

You can download all of our apps from Microsoft AppSource Try 30 days for free. To obtain the app for a fee after the end of the test phase, call up the KUMAVISION Module Setup in Business Central, select the desired app there and complete your purchase with Paypal. Please take a look at our video description.

How much does the app cost?

An Item Costing license costs 215€ per month and environment (plus VAT). You pay for a year in advance.